Features

Selfie & Contact Info

✔ Liveness detection to ensure image is being taken at time of KYC compliance check

✔ Smartphone auto-fill to input basic contact details

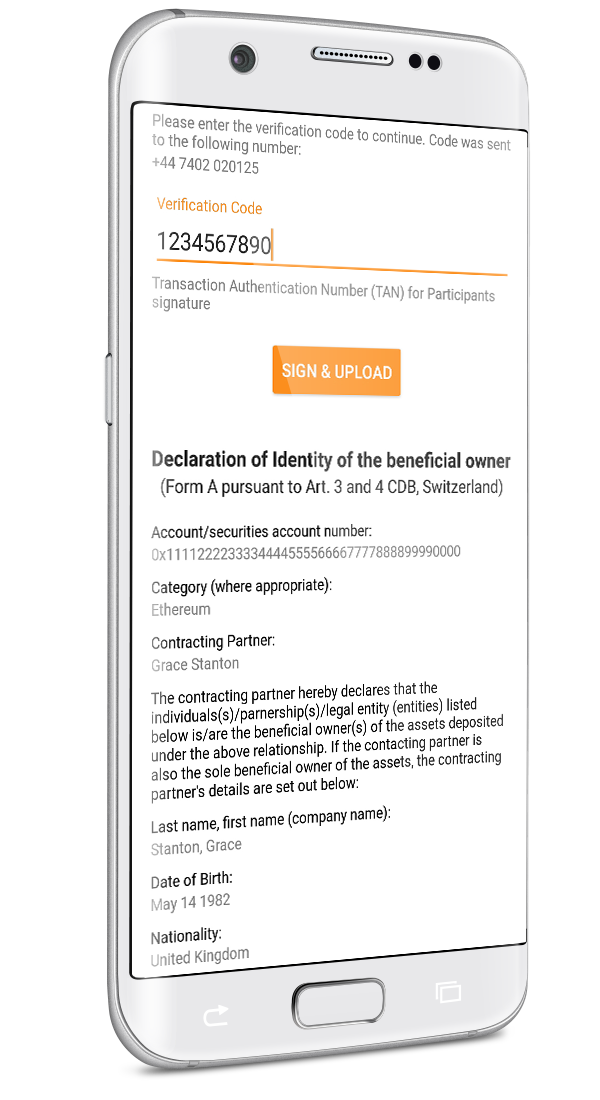

✔ SMS transaction authentication number ('TAN') to reduce false submissions

Proof Of Indentity

✔ High resolution ID scans

✔ Machine Readable Zone 'MRZ' scan for verification of government issued driver license or passport

✔ Scan identifying docs such as utility bills

Video Interview

✔ Advanced anti-gaming feature avoids the need for a video call with a staff member

✔ Liveness detection recording asks user to record the answer to a randomized interview question in real time

✔ Security hologram effect recorded and checked to validate passport/ID

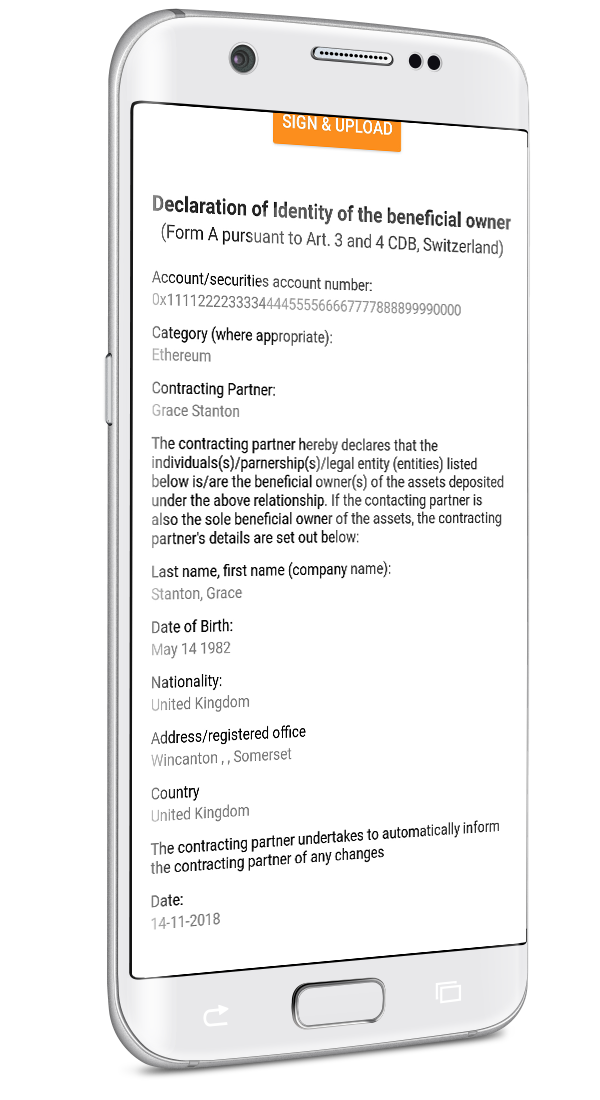

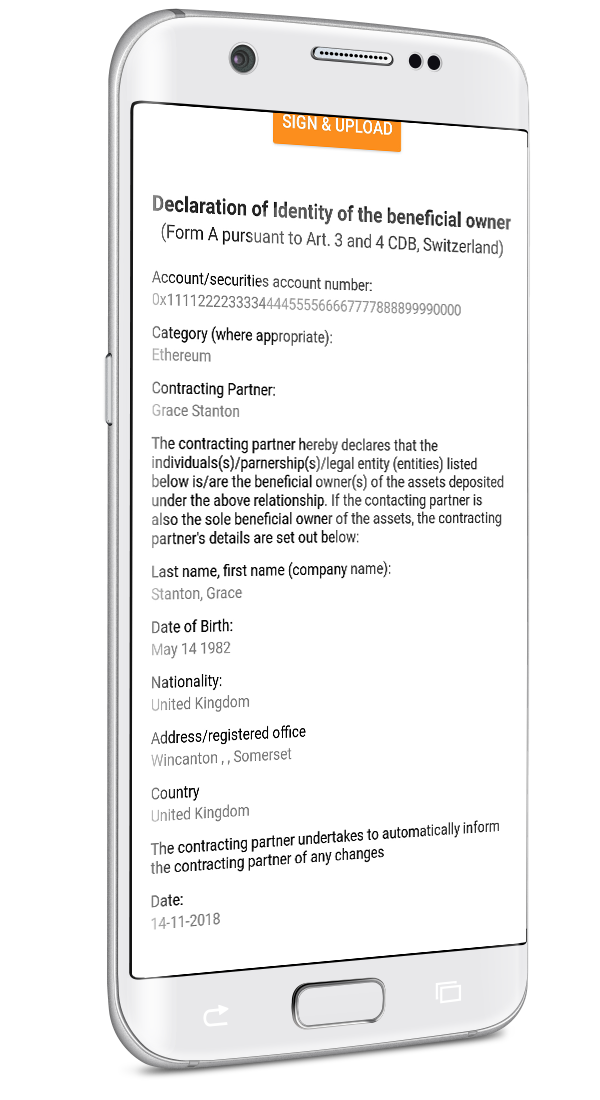

Additional Form Requests Based on Jurisdiction

✔ W-8Ben submission

✔ Integrated US Broker-Dealer Subscription Booklet

✔ SEC Reg D 506(c) Investor Accreditation & more

Secure Upload to Server Memory

✔ Cellular SMS transaction authentication number "TAN" legal wet signature replacement

✔ Anti-tamper, plausible deniability cryptographic technology guarantee

Secondary Trading

Secondary Trading Securities Issuance

Securities Issuance Know Your Customer 'KYC'

Know Your Customer 'KYC' Anti-Money Laundering 'AML'

Anti-Money Laundering 'AML' Cap Table Management

Cap Table Management Data Management Platform

Data Management Platform